Unstoppable Zoe

The European EV market had 29.000 registrations last month, up 30% over the same month last year, being the third best month ever, only behind the incentive-inflated Decembers of 2015 (34k) and 2016 (30k). At this pace, the market is set to reach the 300.000 units mark by year end, with the EV share now standing at a record 1.5%.

The Renault Zoe remains Master

in Command, the Nissan Leaf is proving to be quite resilient and Teslas had

their usual last-month-of-the-quarter peak.

Looking at the Monthly Models Ranking:

#4 Tesla Model S – Tesla had its best

month ever in Europe last March, with over 4.000 units being delivered, and

despite dropping 18% YoY, the Model S managed to be the best-selling Tesla,

with 2.060 units, its best

performance since the arrival of its Model X sibling, with good numbers

especially in Germany, with 457 units, a new record and making it the #1 market

in Europe(!), but also in Norway (297), Switzerland (236) or the Netherlands (228).

Looking ahead, expect deliveries to drop in April and another possible Top 5

appearance next June.

#5 Tesla Model X – The (not so) surprise

of the month, Tesla’s SUV is finally finding its place in the market, reaching

#5 in March, with 2.016 units, a new

European record for the fancy SUV, with the result inflated by Norway (446

units), but with good results across the Continent, as deliveries of the Model

X were on par or better than its older brother, the Model S, like it was the

case of Belgium (112 Model X vs 111 Model S), along with a record performance

(213 deliveries) in the all-important German market. With PHEV incentives

becoming less generous as time passes by, expect many barge-SUV-tax-dodging

buyers to drop their X5’s and XC90 in favor of Tesla’s SUV in the near future.

|

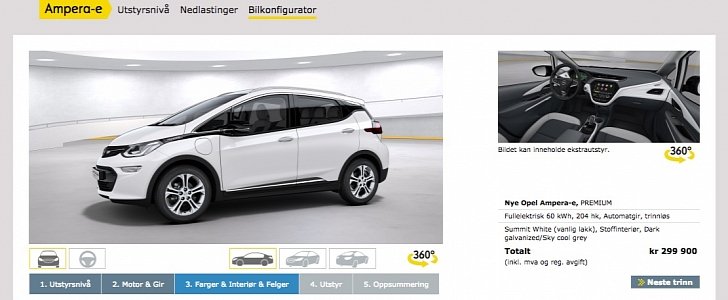

| Over 8.000 orders for the Ampera-e in Europe and the car is not even here yet |

YTD Ranking – Zoe Steady in #1, Nissan Leaf climbs to #2.

Looking at the YTD

ranking, this month there were several significant changes, with the BMW i3 dropping

two positions to Fourth, to the benefit of the Nissan Leaf, now in Second

Place, followed by the Mitsubishi Outlander PHEV.

Outside the podium,

both Teslas had a positive month, with the Model S climbing one position to #5

and the Model X jumping six places to #7, while other climbers were the Audi A3

e-Tron, up two positions to #13 (They can thank the domestic market for that),

while the Hyundai Ioniq Electric, Audi Q7 e-Tron and Nissan e-NV200 / Evalia

all climbed one position due to the three position drop of the VW Golf GTE (245

units, worst result in 29 months), desperately waiting for the restyled version

to arrive.

Underlining the

positive momentum that pure electric cars are having, BEV’s represent once

again the majority of sales in Europe, growing 10% in share from the 44% of

last year to the current 54%. And that’s still without the Opel Ampera-e

(Chevrolet Bolt in European language) and the new VW e-Golf, certainly two

major players for the remainder of the year.

Looking at the manufacturers

ranking, BMW (17%, down 2%) is seated on the Top Spot, followed by Renault (14%,

down 2%) in Second Place, while February Third Placed Volkswagen (8%, down 4%)

was surpassed not by one automaker, not by two, but by three(!), as Nissan,

Mercedes and Tesla (All with 10% share) all surpassed the almighty VW. Time to produce

those restyled Golf plug-ins at full speed…

|

Pl

|

Europe

|

March

|

2017

|

%

|

|

1

|

Renault Zoe

|

3.762

|

9.127

|

14

|

|

2

|

Nissan Leaf

|

3.188

|

5.911

|

9

|

|

3

|

Mitsu. Outlander PHEV

|

3.129

|

5.375

|

8

|

|

4

|

BMW i3

|

1.784

|

5.065

|

8

|

|

5

6

|

Tesla Model S

Volkswagen Passat GTE

|

2.060

1.127

|

3.715

3.562

|

6

5

|

|

7

|

Tesla Model X

|

2.016

|

2.902

|

4

|

|

8

|

Mercedes GLC350e

|

1.126

|

2.503

|

4

|

|

9

|

Volvo XC90 T8

|

857

|

2.416

|

4

|

|

10

11

12

|

Mercedes C350e

BMW 225xe Active Tourer

BMW 330e

|

1.031

761

902

|

2.136

2.117

1.886

|

3

3

3

|

|

13

14

|

Audi A3 e-Tron

BMW X5 40e

|

698

573

|

1.498

1.394

|

2

2

|

|

15

|

Kia Soul EV

|

273

|

1.167

|

2

|

|

16

|

Hyundai Ioniq Electric

|

492

|

1.125

|

2

|

|

17

|

Audi Q7 e-Tron

|

427

|

1.027

|

2

|

|

18

19

20

|

Nissan e-NV200 / Evalia

Volkswagen Golf GTE

Volvo V60 Plug-In

Others

|

390

245

292

3.819

|

980

932

849

9.203

|

2

1

1

15

|

|

TOTAL

|

28.952

|

64.890

|

"Tesla Model S – Tesla had its best month ever in Europe last March, with over 4.000 units being delivered, and despite dropping 18% YoY"

ReplyDeletehttp://ev-sales.blogspot.com/2016/04/europe-march-2016.html

says that For March 2016 2189 Model S were sold in Europe with 3390 year to date.

Using the numbers for March I get

the YoY to be (2060 - 2189)/2189 = -6%

Using the Year to date numbers

the YoY would be (3715-3390)/3390 = 9.5%

Where does the 18% YoY come from?

The final numbers for March 2016 were 2498 deliveries, after the usual end of quarter fine tuning.

DeleteUsually the final update comes with the UK numbers, some three months after publishing each quarter post.

Usually i do not have time to update previous posts, so the backlog of EV Sales are not final numbers for each models in each country.